10 Essential Tips for Rookie Investors in India’s Thriving Stock Market!

Unlock the secrets of India’s booming stock market with these 10 essential tips for rookie investors. Don’t miss out!

If you are a first-time investor looking to explore the exciting world of the Indian stock market, you’ve come to the right place! India’s stock market has seen remarkable growth in recent years, enticing investors with its potential for substantial returns. However, investing in stocks also comes with inherent risks.

Fear not, dear reader! In this blog post, we’ve curated a comprehensive guide on the top ten valuable tips for first-time investors in the Indian stock market. So, let’s dive right in and empower you to make smart investment decisions!

Understand the Basics for Rookie Investors

Before stepping into the captivating realm of stock market investments, it’s crucial to grasp the basics of how it all works. Stocks, stock exchanges, and brokerage accounts are a few fundamental terms worth understanding.

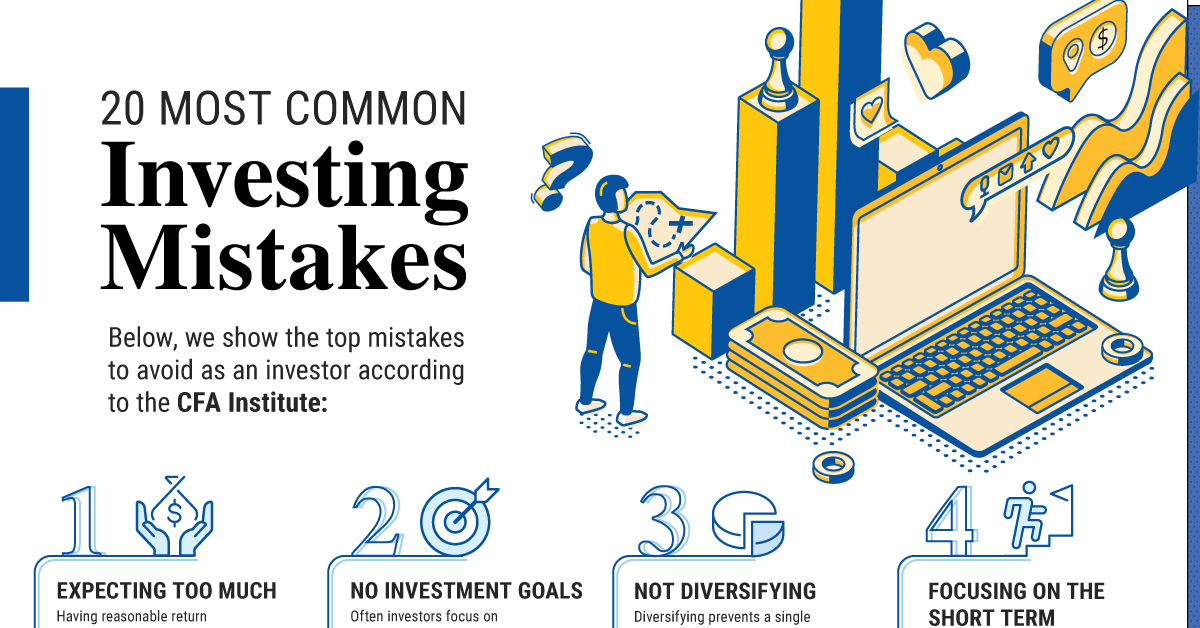

Set Clear Investment Goals

Every investor should set clear investment goals to guide their financial journey. Determine what you want to achieve through your investments and set a realistic time frame for achieving those objectives.

Are you investing for retirement, purchasing a dream home, or funding education? Aligning your investment strategy with your aspirations will help you stay focused and motivated throughout your investment journey.

Assess Risk Tolerance

Understanding your personal risk tolerance is critical to crafting a well-rounded investment portfolio. Risk tolerance refers to your ability to withstand fluctuations and potential losses in the stock market.

Some investors have a high-risk tolerance and can handle market volatility, while others prefer a more conservative approach. Evaluate your capacity to bear losses and choose investment strategies that align with your risk appetite.

Strictly Adhere to Asset Allocation

Diversification is the key to managing risk and optimizing returns. Building a well-diversified investment portfolio involves spreading your investments across different sectors and asset classes.

A balanced mix of high-, medium–, and low-risk investments can help mitigate potential losses in case of market downturns. Regularly assess and rebalance your portfolio to maintain an optimal asset allocation that meets your risk tolerance and investment goals.

Research and Analyze

Never underestimate the power of research! Thoroughly researching potential investment opportunities is crucial for making well-informed decisions. Learn how to read financial statements, study market trends, and analyze company performance.

Image courtesy of www.statista.com via Google Images

Image courtesy of www.statista.com via Google Images

Keep yourself updated with news and changes affecting the stock market. Numerous online resources, financial news websites, and research reports can offer valuable insights to refine your investment decisions.

Start with a Demat Account

A Demat (Dematerialized) account is essential for trading in the Indian stock market. This account holds your shares electronically, eliminating the need for physical share certificates.

Opening a Demat account is a straightforward process. Choose a reputable depository participant (DP) and provide the required documents. Once you have your Demat account in place, buying and selling stocks will be seamless and hassle-free.

Seek Guidance from Finance Professionals

Even the most experienced investors seek financial advice, and as a first-time investor, you should too! Certified financial advisors possess the expertise to guide you through the nuances of investing.

Image courtesy of www.fool.com via Google Images

Image courtesy of www.fool.com via Google Images

Consider consulting professionals for insights into investment strategies and risk management. Their guidance can help you make sound investment decisions and avoid common pitfalls along the way.

Plan for Volatility and Market Fluctuations

The stock market is notorious for its volatility, and market fluctuations are inevitable. Prepare yourself mentally and financially to withstand short-term market ups and downs.

Stay focused on your long-term goals and refrain from making reactive decisions based on short-term market movements. Remember, investing is a marathon, not a sprint!

Regularly Track and Review Investments

Monitor your investments regularly, as you would nurture a growing plant. Staying updated with your portfolio’s performance is crucial for making timely adjustments and informed decisions.

Image courtesy of www.visualcapitalist.com via Google Images

Image courtesy of www.visualcapitalist.com via Google Images

Investment tracking tools and apps can simplify the task, offering real-time updates and analytical insights. By periodically reviewing your investments, you can ensure they keep pace with your evolving financial goals.

Learn from Mistakes and Stay Committed

Investing is a continuous learning process, and mistakes are bound to happen. Embrace them as learning opportunities rather than setbacks, and never let them discourage you.

Stay committed to your investment plan through the inevitable highs and lows. Remember, successful investing is a long-term endeavour that requires patience, persistence, and adaptability.

Conclusion: Tips for Rookie Investors

Now armed with these ten essential tips, you are well-prepared to embark on your investment journey in the captivating world of the Indian stock market! Educate yourself, set clear goals, analyze market trends, and remember to seek guidance from professionals.

India’s stock market offers immense growth potential, but it requires a disciplined and informed approach. Stay focused on your long-term goals, be patient, and always remember that investing is a journey of self-improvement and wealth creation.

So, what are you waiting for? Take that first step, and unlock the doors to exciting investment opportunities in India’s thriving stock market!

Click here for more such articles

FAQs: Rookie Investors

- Q1: What is a Demat account, and why is it necessary for stock market investment?

- A: A Demat account holds shares electronically, eliminating the need for physical certificates. It is essential for seamless trading in the Indian stock market.

- Q2: How can I assess my risk tolerance as a rookie investor?

- A: Evaluate your ability to handle market fluctuations and potential losses. Choose investment strategies that align with your comfort level.

- Q3: Why is diversification important in an investment portfolio?

- A: Diversification helps manage risk by spreading investments across different sectors and asset classes, optimizing returns.

- Q4: How often should I review my investment portfolio?

- A: Regularly monitor your portfolio to make timely adjustments. Investment tracking tools and apps can simplify the task.

- Q5: What should rookie investors focus on during market volatility?

- A: Stay focused on long-term goals, refrain from reactive decisions, and mentally prepare for short-term market ups and downs.

Comments

Post a Comment